What Is A Double Top Pattern In Technical Analysis?

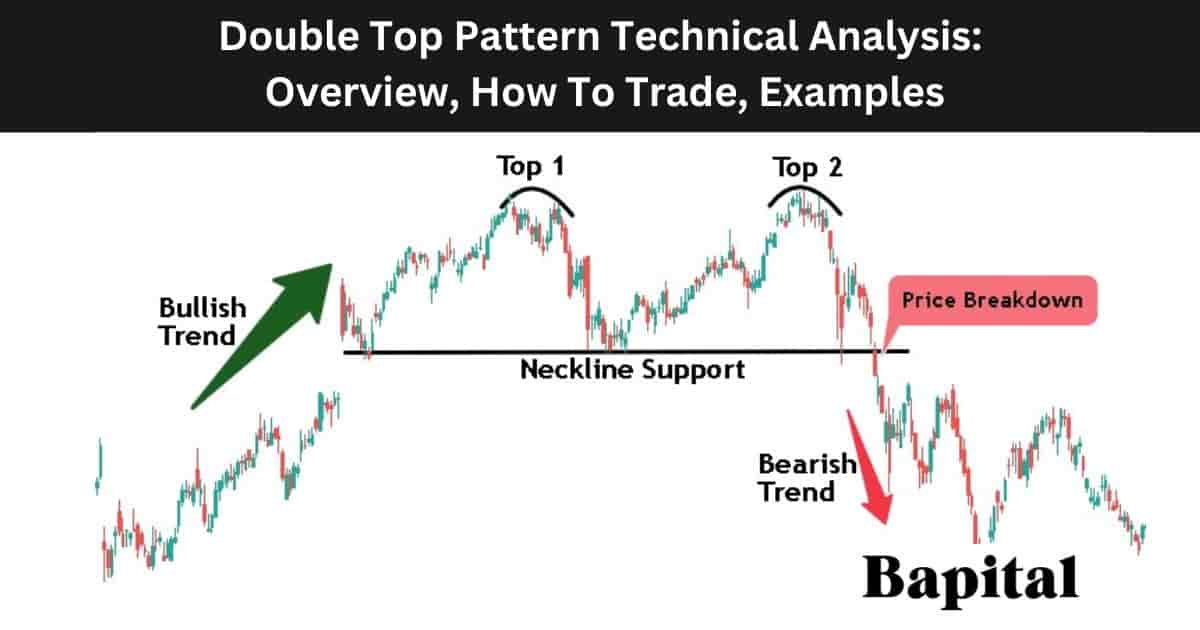

A double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated by a temporary trough or pullback. Double top patterns are completed when the price decreases below the support trendline of the trough that separates the two peaks. A double top pattern resembles the letter "M" of the English alphabet.

What Is An Alternative Name For a Double Top Pattern?

The double top pattern's alternative name is a "double top reversal".

Is a Double Top Pattern Bullish Or Bearish?

A double top pattern is a bearish pattern indicating downward market prices, increasing bearish momentum, and declining bullish momentum.

What Does a Double Top Pattern Mean In Technical Analysis?

A double top pattern means that the market may reverse from bullish price action to bearish price action. The price of the market attempted to make a new high twice but failed. Once the price breaks down below the neckline of the double top pattern, it indicates that the market may trend to lower prices.

What Is The Importance Of a Double Top Pattern In Technical Analysis?

A double top pattern is important for indicating bullish trend price exhaustions, potential profit taking amongst bullish traders, increased selling pressure, and bearish reversals.

What Is The Opposite Of a Double Top Pattern?

A double top pattern's opposite is the double bottom pattern which is a bullish pattern and is shaped like an inverse double top.

Whats The Difference Between A Double Top And Double Bottom Pattern?

The double top pattern differences with a double bottom pattern are its shape with the double top shaped like the letter "M" whereas a double bottom is shaped like the letter "W". The second difference between the two patterns is what it indicates with the double top indicating potential bearish price movement whereas a double bottom indicates potential bullish price movement.

Is a Double Top Pattern a Continuation or Reversal Pattern?

A double top pattern is a price reversal pattern and it is not a continuation pattern.

What Are The Components Of a Double Top Pattern?

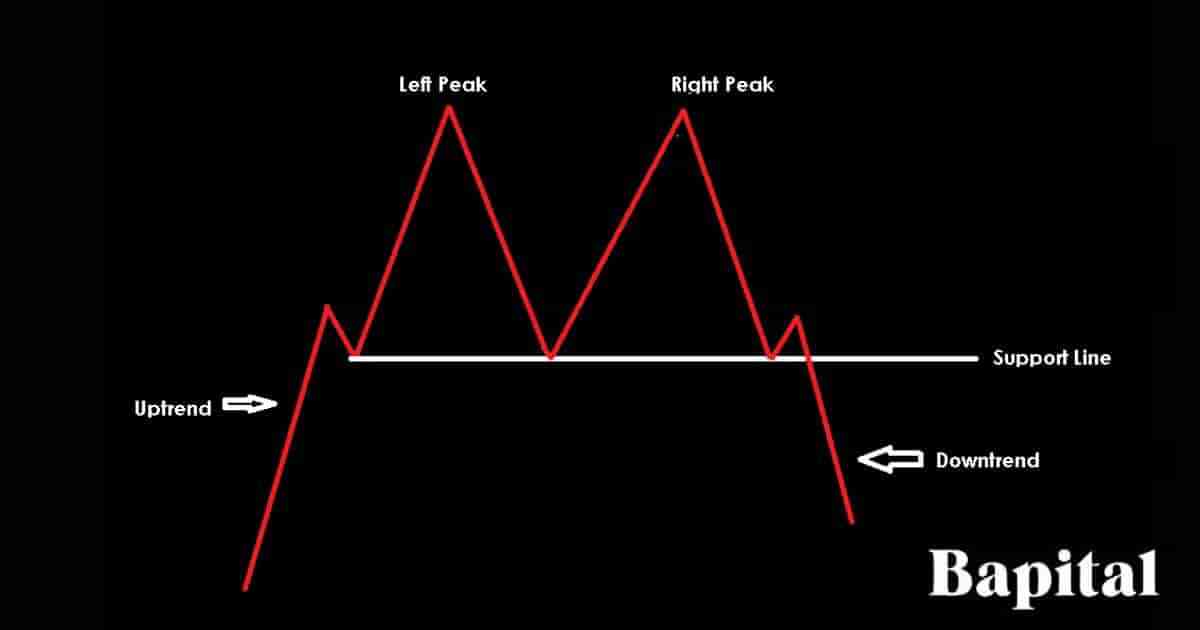

The 5 double top pattern components are an upward trend, left peak, trough, right peak, and a support line.

1. Upward Trend

The double top pattern's first component is an upswing trend which sees asset prices increase marking higher swing highs and higher swing lows.

2. Left Swing Peak

The second component is the formation of the first high point (left peak) resistance level which is formed as prices reach a certain level during the uptrend. This peak represents the end of the first upward price movement and acts as a resistance area.

3. Trough

The pattern's third component is the trough which forms when prices decline and pullback, forming a trough or valley. This temporary retracement suggests a brief pause in the upward price momentum.

4. Right Swing Peak

The fourth component is the formation of the second high point (right peak) which is formed when prices rally again to a similar level as the first peak, forming the second peak. This is a critical point in the pattern as it indicates that the previous left peak high could not be penetrated.

5. Horizontal Support Trendline (Neckline)

The fifth component is the support trendline (neckline) which is a horizontal support line drawn through the lows of the trough that separates the two peaks. The pattern is considered complete and confirmed when prices break below this neckline, signaling a potential bearish trend reversal.

What Is The Formation Process Of a Double Top Pattern?

The double top pattern formation process begins firstly with a bullish market price trend with the markets forming higher highs and higher lows as the price rises. The market price reaches a high point before a price retracement occurs signaling the formation of the first peak component of the pattern.

Secondly, price drops temporarily to a support zone where there is a price bounce which forms the trough component of the pattern.

Thirdly, price coils and pushes back to the prior resistance level where it is met with selling pressure and starts to drop again marking the formation of the right-hand side peak component of the pattern.

Fourthly, the price falls from the resistance zone and starts to penetrate the support area rendering the double top pattern formation completed.

What Happens After a Double Top Pattern Forms?

After a double top pattern forms, a bullish to bearish price reversal occurs with the market price dropping below the pattern support area and trending lower. This downside breakout is a signal that the previous uptrend is losing momentum, and a reversal is underway.

How Long Does a Double Top Take To Form?

Double top pattern formation duration ranges from 45 minutes and more on a 1-minute price chart up to 45 years and more on a yearly price chart. To calculate the double top pattern formatiomn duration, multiple the timeframe used by 45. For example, a double top pattern on a 30 minute price chart takes 1,350 minutes (30 minutes x 45) to form.

How Often Do Double Top Patterns Form?

Double tops form 3 - 5 times per year on the daily price charts. Shorter timeframe price charts under an hourly timeframe sees double tops form more frequently.

What Type Of Price Charts Do Double Tops Form On?

The double top pattern forms on candlestick charts, bar charts, open high low close (OHLC) charts, point and figure charts, area charts, and line charts.

What Markets Do Double Top Patterns Form In?

Double top patterns form in all global markets including stocks, bonds, futures, ETFs, commodities, cryptocurrencies, forex, and indices.

What Timeframe Price Charts Do Double Top Patterns Form On?

A double top pattern forms on all timeframes from intraday 1-second charts up to a yearly chart period.

How To Identify a Double Top Pattern?

To identify a double top pattern, look for market securities in rising bullish trends but showing signs of bullish price exhaustion with price retracements. After the first swing high resistance price is marked, wait for a price retest of the resistance level and observe the price action. If the price fails at the same resistance area, the second swing high peak of the pattern is observed. Watch as price drops from this resistance point to the support level. If the price bounces slightly off this support area before penetrating and dropping below it, the double top pattern has been identified.

How Do Traders Find Double Tops?

Double top formations are found by scanning the financial markets with a double top scanner, checking the social media profiles of top traders or expert chartered market technicians (CMT), browsing the price charts manually, or by checking trading broker software.

How Do Traders Scan For a Double Top Pattern?

Scanning for double top patterns involves using TradingView chart pattern scanner, stockcharts.com chart pattern screener, or browsing the asset price charts manually to spot the pattern in real time.

How Do Traders Draw a Double Top Pattern?

The double top pattern drawing involves identifying two equal height resistance points and plotting the number 1 and 2 above them. Then, draw a horizontal support trend line from left to right connecting the pattern's troughs (low points) together that marks the pattern support zone.

How To Trade a Double Top Pattern

The double top pattern trading steps are listed below.

- Identify a double top pattern on a financial market chart

- Enter a short trade on a pattern support break

- Place a double top price target order

- Set stop-loss order above breakdown candlestick high

- Conduct post-trade analysis

1. Identify a Double Top Pattern On A Financial Market

The first double top pattern trading step is to identify a double top pattern by using a chart pattern market scanner to find the double top fomations in various market assets.

2. Enter A Short Trade On A Pattern Support Break

The second double top pattern trading step is to enter a shorting position when the market price falls below the support level.

What Is The Entry Point Of a Double Top Pattern?

A double top pattern entry point is set when the price moves below the support line of the pattern. This is a short entry point for the trade. Watch for an increase in selling volume as the price declines below this support level.

3. Place a Double Top Pattern Price Target Order

The third double top pattern trading step is to place a pattern target order by measuring the pattern distance between the resistance level and support level and subtracting this number from the sell entry price.

What Is The Price Target Of a Double Top Pattern?

A double top pattern target is set by calculating the height of the pattern between the neckline support level and the swing high peak resistance level and subtract this number from the short entry price.

For example, if the short entry price of this pattern is $40 and the pattern peak resistance level is $45, the price target is $35 ($40 - $5).

What Is The Price Target Calculation Formula Of a Double Top Pattern?

The double top pattern price target formula for calculating the price target is Double Top Price Target = Short Entry Price - Pattern Height.

4. Set A Stop-Loss Order Above Breakdown Candlestick High Price

The fourth double top pattern trading step is to set a stop-loss order above the breakdown candlestick highest price. Put a stop market order or a stop limit order but be aware of order slipapge.

What Is The Risk Management Of a Double Top?

Double top pattern risk management is set by placing a stop-loss order above the breakout candlestick price high. A risk of 1% of trading capital is the risk amount when trading double tops so traders adjust their postion size accordingly. Traders use stop losses to protect against false signals.

What Is The Risk Reward Ratio When Trading Double Tops?

The double top pattern risk to reward ratio is 3:1 meaning $3+ reward for every $1 risk.

What Are The Risks When Trading Double Tops?

The double top pattern trading risks are price gapping up on positive news, order slippage skewing the reward to risk ratio, and the market becoming less liquid after trade entry.

What Are The Common Mistakes When Trading a Double Top?

The double top pattern common trading mistakes are using large amounts of trading leverage, ignoring important news announcements, and wrong stop-loss order placement.

5. Conduct Post-Trade Analysis

The fifth double top pattern trading step is to conduct post-trade analysis. Include trade manangement information like the entry price, exit price, stop-loss price, and annotated price charts.

What Is a Double Top Pattern Trading Strategy?

A double top pattern trading strategy is the U.S. market securites double top trailing stop strategy. Scan U.S. equities using a chart pattern screener for double top pattern formations. Place a 10 exponential moving average (EMA) overlay on the market chart. Enter a short position when the market price falls below the support line on rising seller volume. Place a stop-loss order 5 cents above the 10 EMA price. Use a trailing stop-loss order and trail the stop loss along the EMA as the price drops lower. Exit the trading position when the market price closes above the 10EMA.

What Type Of Trading Strategies Can Double Tops Be Traded In?

The double top pattern is traded in scalping strategies, day trading strategies, swing trading strategies, and longer-term investing strategies.

What Are The Trading Rules Of a Double Top Pattern?

The double top pattern trading rules are below.

- Risk a maximum of 1% trading capital per trade

- Avoid trading prior to or during important market news events

- Calculate the trade entry price, profit target point, and stop loss price prior to entering a trade position

- Avoid trading double tops in volatile markets with large price fluctuations or illiquid markets with low trading volume

- Adapt to changing market conditions dynamically

- Adjust trade position size to meet 1% capital risk

What Type Of Traders Trade a Double Top Pattern?

A double top pattern is traded by scalpers, day traders, swing traders, position traders, professional technical analysts, and active investors.

What Type Of Traders Have The Most Success With Trading Double Tops?

The double top pattern's most successful traders are swing traders and position traders as the pattern's win rate and reliability is higher on longer trading time horizons.

Double Top Pattern Examples

Double top chart pattern historical examples are below.

Double Top Stock Market Example

A double top pattern stock market example is illustrated on the daily stock chart image of Zoom Video Communications Inc (ZM) above. The stock price forms the pattern formed after a short term bullish trend in the market before there was a complete price reversal and the stock price declined. There is a price retest before the stock declines in a bearish downtrend.

Double Top Forex Market Example

A double top pattern forex market example is illustrated on the weekly forex chart of GBP/USD currency. The pattern formed after a multi-week bullish run in the currency. The currency price tested the resistance line twice before reversing and moving downwards over the new few months.

What Are The Benefits Of a Double Top Pattern?

The double top pattern benefits are below.

- Helps capture large bearish moves: A double top pattern helps traders capture large bearish moves in the market from a favorable low risk entry point

- Helps provides logic and understanding: A double top pattern helps provide logic and understanding to the price action

- Helps with taking profits on bullish trades: A double top pattern helps traders identify when to take profts on their long positons as the pattern indicates a reversal of the bullish trend is imminent

- Favorable risk reward ratio: Double top patterns offer favorable low risk to high reward opportunities for traders with the reward to risk ratio typically $3+ reward for every $1 risked

- Beginner Friendly: A double top pattern is beginner friendly and easy for new traders to understand with no advanced concepts required for understanding

What Are The Limitations Of a Double Top Pattern?

The double top pattern limitations are below.

- Price targets not guaranteed: Double tops can penetrate the support level and move lower but reverse before reaching the pattern target which frustrates some novice traders

- False breakouts: The double top pattern can generate false breakout signals which leads to traders taking losses on their trades as the market asset fails to continue falling lower

- Subjectivity: The double top is subjective and novice traders can identify a pattern differently compared to pro traders identifying patterns

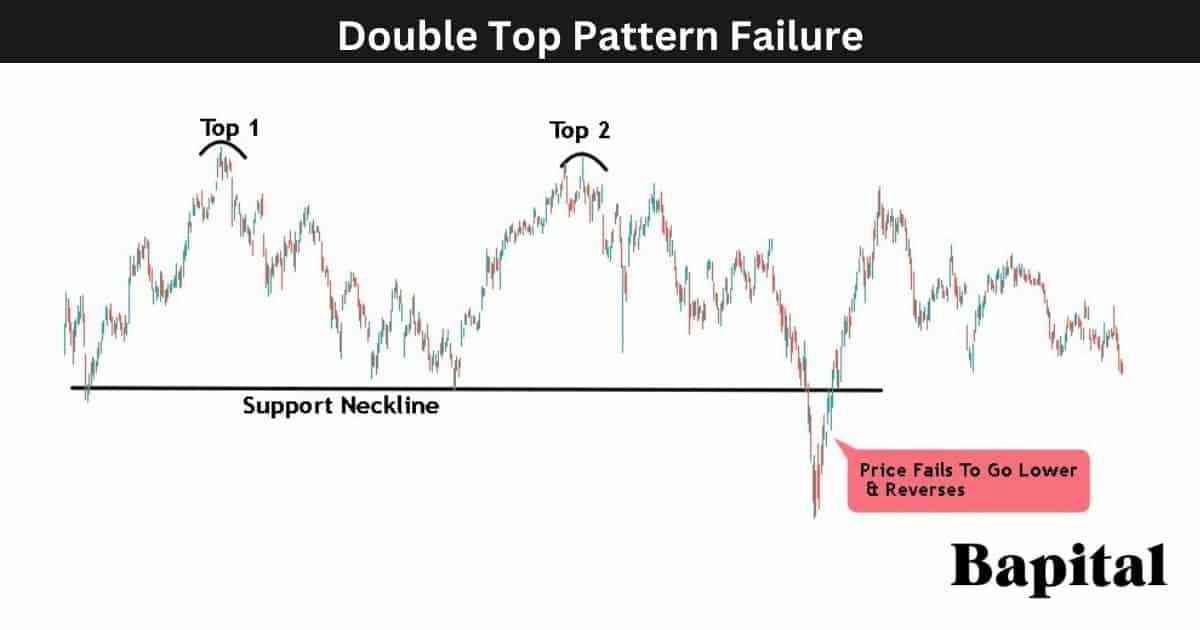

What Is a Double Top Pattern Failure?

A double top pattern failure, also known as a "failed double top reversal", is when a double top forms but fails. The double top is invalidated and considered a failed double top when the market security price breaks down and falls below the price support level but quickly results in a major reversal and turns bullish. A failed double top pattern is a bullish signal.

What Causes a Double Top To Fail?

The double top failure causes are below.

- Market sentiment change: Strong market sentiment or positive fundamental factors supporting the price upswing can cause a double top pattern to fail and not be as effective in predicting a market reversal. External market factors can override the pattern's significance

- Influx of large buyers: Large buyers influx can cause the double top pattern to fail and reverse from market price depreciation to market price appreciation

- Unexpected positive news: Unexpected positive news can cause a double top pattern to fail as the market news may cause the price to start rising

What Technical Indicators Are Used With Double Tops?

The double top pattern is traded with technical trading indicators like the exponential moving average indicator, volume indicator, moving average convergence divergence (MACD), bollinger bands, volume weighted average price (VWAP), and the relative strength index (RSI) indicator in technical analysis. These trading indicators help find a technical reversal and technical trend change.

What Is The Most Popular Technical Indicator Used With Double Tops?

A double top pattern's most popular technical analysis indicator is the volume indicator which helps measure buying volume and selling volume as the pattern developes.

What Is The Psychology Behind a Double Top Pattern?

The double top pattern market psychology indicates a shift from bullish optimism in market securities to increasing bearish sentiment. As prices consolidates forming the two swing high points, there is uncertainty among traders.

The second peak represents a failed attempt to surpass the previous high, creating frustration among buyers who were expecting a continuation of the uptrend. As prices decline below the neckline support line, triggering the pattern's confirmation, it signals a realization among market participants that the bullish momentum has diminished, and selling pressure is gaining strength.

The pattern's completion prompts further selling as traders seek to capitalize on the anticipated downtrend, reflecting a shift in market sentiment from optimism to caution and, eventually, to a more bearish outlook.

What Are Statistics Of the Double Top Pattern?

The double top pattern statistics are illustrated below.

How Accurate Is a Double Top Pattern?

The double top patterns accuracy rate is 38% from our data of 1,044 of these chart pattern formations.

Is a Double Top Pattern Reliable?

Yes, the double top pattern is reliable provided traders follow the trading rules with higher timeframe weekly and monthly price charts patterns being more reliable than short term patterns.

What Market Conditions Is a Double Top Most Reliable?

A double top pattern is most reliable in bearish trend markets with market prices declining in an orderly manner.

What Market Conditions Is a Double Top The Least Reliable?

A double top pattern is least reliable in choppy and volatile market conditions with market prices fluctuating wildly in no clear direction.

Is a Double Top Pattern Profitable?

Yes, a double top pattern is profitable as the average success rate is 38% and the average return to risk ratio is 3 to 1. This means for every 100 trades, a trader wins 38 trades making 3 units (114 units total) and loses 37 trades losing 1 unit (62 units total). Therefore, over 100 trades, a trader should hypothetically net 52 units (114 units - 52 units). Be aware that past performance is not indicative of future results and a traders own results may vary.

What Are Alternatives To a Double Top Pattern?

The double top pattern alternatives are listed below.

What Are Double Top Pattern Resources To Learn From?

Double top pattern resources to learn from include books, websites, courses and pdfs.

What Are Books To Learn About Double Top Patterns?

Double top pattern books to learn from are "Technical Analysis of Financial Markets" by technical analyst John Murphy and "Encyclopedia of Chart Patterns" by Thomas Bulkowski.

What Are Websites To Learn About Double Top Patterns?

Double top pattern websites to learn from are Bapital.com, Investopedia.com, and Stockcharts.com.

What Are Courses To Learn About Double Top Patterns?

Double top pattern courses to learn from are "The Ultimate Chart Patterns Trading Course" by Rayner Teo and "Technical Analysis: Chart Pattern Trading For Beginners" by Wealthy Education.

What Are The Key Facts Of a Double Top Pattern?

The double top pattern key facts are below.