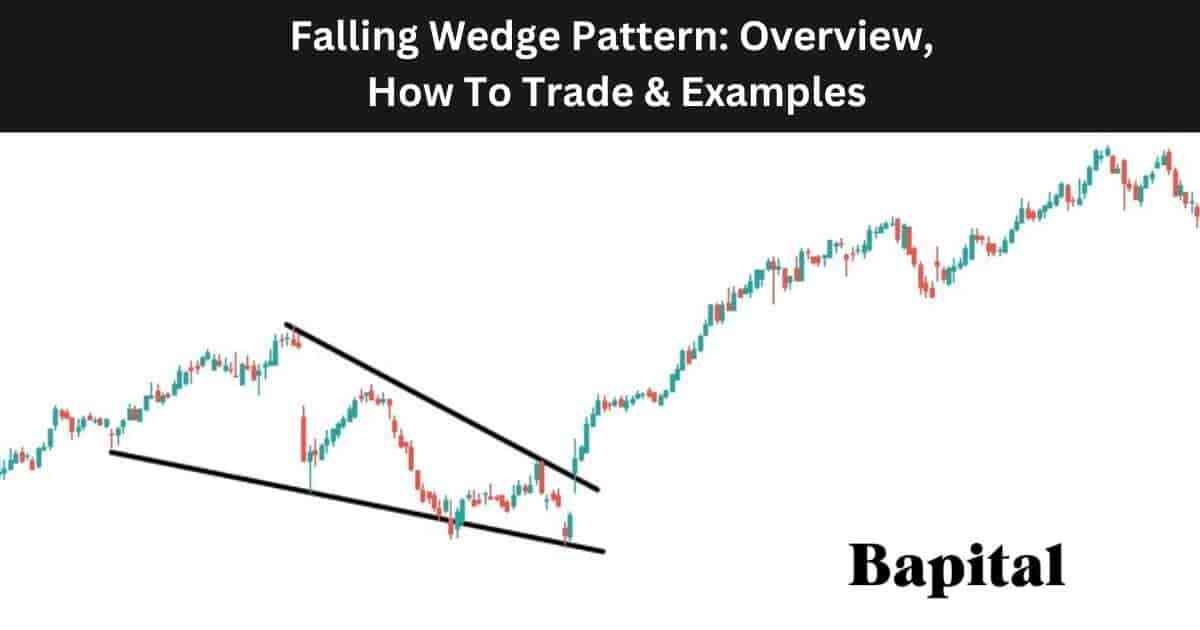

What Is a Falling Wedge Pattern In Technical Analysis?

A falling wedge pattern is a pattern in technical analysis that indicates bullish price trend movement after a price breakout. The falling wedge chart pattern is considered a bullish continuation pattern when it forms in an already established bullish uptrend. The falling wedge pattern is considered a reversal pattern when it forms at the end of a bearish trend. Falling wedges have two converging downward sloping resistance and support trendlines.

What Is An Alternative Name For a Falling Wedge Pattern?

A falling wedge pattern's alternative name is "descending wedge pattern" or "bullish wedge pattern".

What Is The Importance Of a Falling Wedge Pattern In Technical Analysis?

The falling wedge pattern is important as it provides valuable insights into potential bullish trend reversals and bullish trend continuations.

Is a Falling Wedge Pattern Bullish or Bearish?

A falling wedge pattern is a bullish signal that indicates future price increases in a market. It is not a bearish signal.

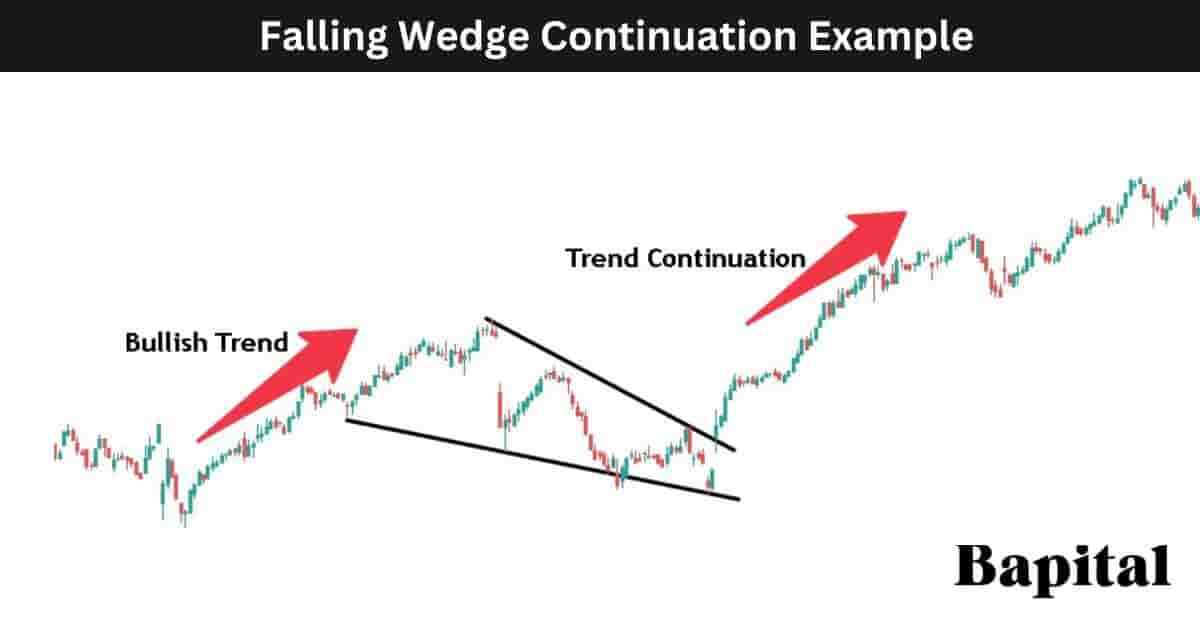

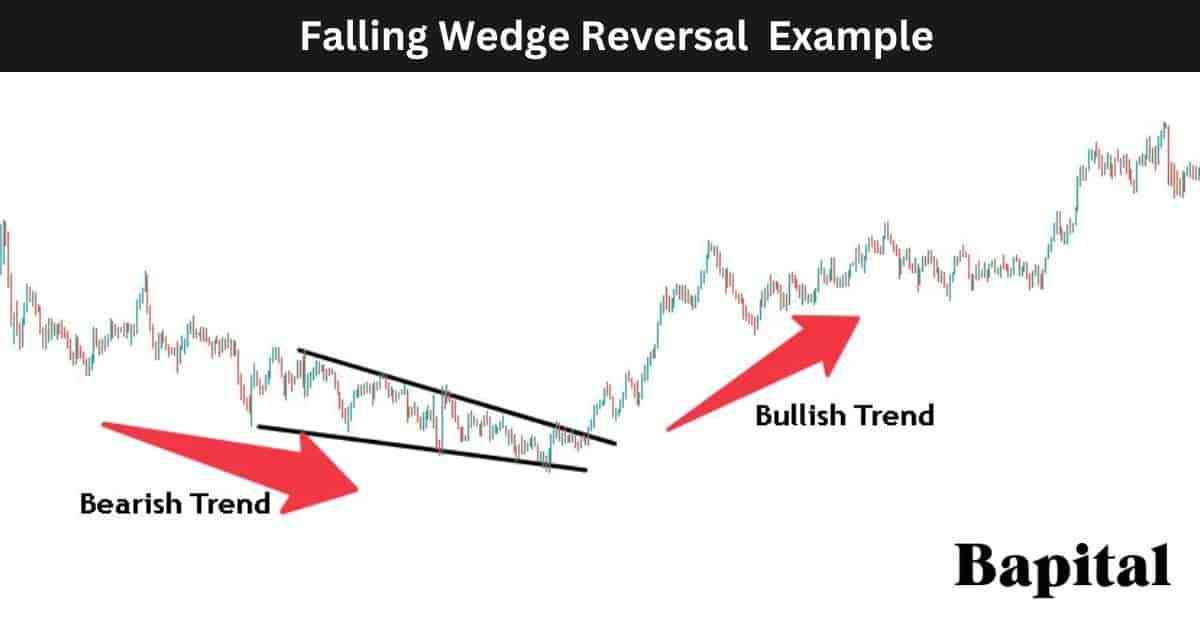

Is a Falling Wedge Pattern a Continuation or Reversal Pattern?

A falling wedge pattern can be either a continuation pattern or a reversal pattern depending on the market environment it forms in. A falling wedge pattern is a continuation pattern when it forms after a price consolidation in a bullish uptrend and a falling wedge is a reversal pattern when it forms after a price consolidation during a bearish downtrend.

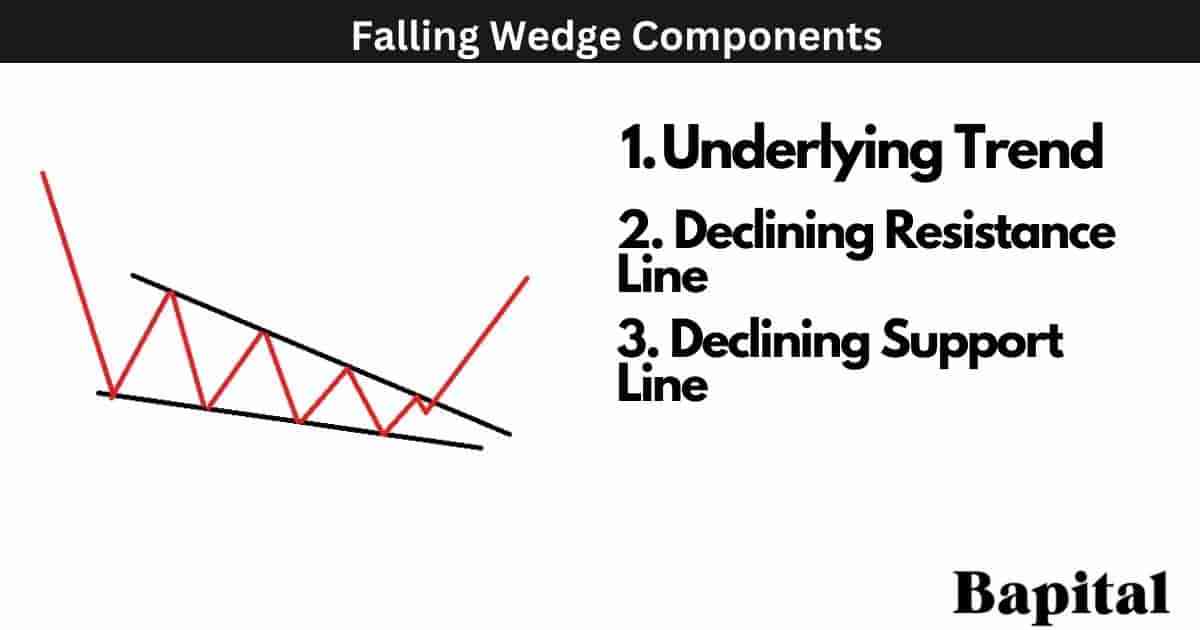

What Are The Components Of a Falling Wedge?

The falling wedge pattern components are an underlying bullish or bearish trend component, price consolidation component, declining resistance trendline component, and a declining support trendline component.

What Is The Formation Process Of a Falling Wedge Pattern?

The falling wedge pattern formation process begins with a price downtrend with market prices converging between lower swing high points and lower swing low points.

Secondly in the formation process is the identification of the resistance and support trendlines. Traders identify two key trendlines that define the falling wedge which are the downtrending resistance line and the downtrending support line.

Thirdly in the formation process is decreasing volatility as market prices moves lower. As the falling wedge evolves, volatility and price fluctuations decrease significantly. The price range between the converging trendlines becomes narrower, reflecting in market uncertainty reduction and a contraction in selling pressure.

Fourthly in the formation process is a gradual volume reduction. During the falling wedge formation, traders observe a gradual decline in trading volume. This diminishing volume suggests a weakening of the strong selling pressure (red bars).

Fifthly in the pattern formation process is the completion of the falling wedge when the price apporoaches the apex which is the point where the two trendline converge. At this stage, the pattern is considered formed, but it is not yet confirmed.

What Happens After a Falling Wedge Forms?

After a falling wedge pattern forms, price rises above the downtrend resistance level and continues higher making higher swing lows and higher swing highs in a bullish trend direction with increasing bullish momentum.

What Causes a Falling Wedge Pattern To Form?

A falling wedge is caused by buyers becoming more active as sellers lose their ability to move prices lower. The support line of the pattern demonstrates a willingness amongst buyers to enter the market at lower price levels causing the market price to coil. The bearish to bullish turnaround in the pattern is caused by buyers aggressively buying which pushes prices higher in upward momentum.

How Long Does a Falling Wedge Pattern Take To Form?

A falling wedge pattern takes a minumum of 35 days to form on a daily timeframe chart. To calculate the formation duration of a falling wedge, multiple the timeframe by 35. For example, a falling wedge pattern on a 15 minute price chart would take a minimum of 525 minutes (15 minutes x 35) to form.

How Often Do Falling Wedge Patterns Form?

Falling wedge patterns form 3 to 5 times per year on a daily timeframe price chart depending on market conditions. Shorter timeframe price charts see the pattern occur more regularly.

How To Identify a Falling Wedge Pattern

Identifying a falling wedge pattern involves recognizing specific visual and structural characteristics of the falling wedge on a price chart. First, identify a prevailing downtrend in the market, where prices consistently form lower highs and lower lows. As the downtrend progresses, look for a narrowing price range between two converging trendlines. The first trendline, known as the downtrend line or resistance line, connects the declining highs. The second trendline is the support line, linking the lower lows. These trendlines should slope downward and come together, creating a wedge-like shape.

Additionally, observe diminishing trading volume during the pattern's development which indicates a decrease in selling pressure. Confirmation of a falling wedge often comes with a price breakout as the price moves above the upper trendline. Understanding these elements enables traders to identify and leverage falling wedge patterns for buying opportunities.

How Do Traders Find Falling Wedge Patterns?

Falling wedge pattern formations are found in markets by scanning the financial markets with a falling wedge charting screener, checking the online profiles of top traders or expert chartered market technicians (CMT), browsing the market charts manually, or by checking trading/investment broker software.

How Do Traders Draw a Falling Wedge Pattern?

Falling wedge pattern drawing involves identifying two lower swing high points and two lower swing low points and drawing the components on a price chart. Draw a declining trendline from left to right connecting the lower swing high prices together. Then, draw a second declining trendline from left to right connecting the lower swing low prices together which is the pattern's support level.

What Markets Do Falling Wedge Patterns Form In?

A falling wedge pattern forms in all markets including capital markets, money markets, derivatives markets, foreign exchange markets, commodity markets, cryptocurrency markets, interbank markets, over the counter (OTC) markets, equity markets, and fixed-income markets.

What Timeframes Do Falling Wedge Patterns Form On?

Falling wedge patterns form on all timeframes from short term 1-second timeframe charts to longer-term yearly timeframe price charts.

What Is The Most Popular Timeframe To Trade Falling Wedge Patterns?

The most popular timeframe to trade a falling wedge pattern is the daily price chart.

What Is The Least Popular Timeframe To Trade Falling Wedge Patterns?

The least popular timeframe to trade a falling wedge pattern is the 1-second price chart as it generates many false signals on this timeframe.

How To Trade a Falling Wedge Pattern

The falling wedge pattern trading steps are listed below.

- Enter a buy trade as price rises above the resistance point

- Set a price target order

- Place a stop-loss order under the pattern support level

- Adjust trade position size to risk 1% of trading capital

1. Enter A Buy Trade As Price Rises Above Resistance Point

The first falling wedge trading step is to enter a buy trade position when the price of the market where the pattern forms rises above the downward resistance line. As the price penetrates this level, watch for increasing bullish volume.

What Is a Falling Wedge Pattern Entry Point?

A falling wedge pattern buy entry point is set when the financial market price penetrates the downward sloping resistance line in an upward bullish direction.

2. Set A Price Target Order

The second falling wedge step is to place a profit target order. A price target order is set by calculating the height of the pattern at its widest point and adding this number to the buy entry price to get the target price level.

What Is the Falling Wedge Pattern Price Target?

A falling wedge pattern price target is set by measuring the pattern height between the declining resistance line and declining support line and adding this height to the buy entry price point.

What Is the Falling Wedge Pattern Price Target Calculation Formula?

The falling wedge pattern price target calculation formula is: Falling Wedge Price Target = Pattern Height + Buy Entry Price.

3. Place A Stop-Loss Order Under The Pattern Support Level

The third step of falling wedge trading is to place a stop-loss order at the downtrending support line. Use a stop market order or a stop limit order but be aware of potential slippage.

What Is The Falling Wedge Pattern Risk Management?

A falling wedge pattern risk management involves placing a stop-loss order at the downward sloping support level of the pattern. The stop-loss order can be a limit stop-loss order or a market stop-order. Account for order slippage when placing the stop-loss.

What Is The Risk/Reward Ratio When Trading Falling Wedges?

A falling wedge pattern risk/reward ratio is 3.5:1 meaning a reward of $3.50+ for every $1 risked.

What Is a Falling Wedge Pattern Trading Strategy?

A falling wedge pattern trading strategy is the falling wedge U.S. equities strategy. Scan all U.S. stocks for falling wedge pattern formations. Apply a 12 exponential moving average overlay to the stock charts. Enter a long trade when a stock price breakout from the pattern occurs. Set a stop-loss at the 12EMA price level. Trail the stop-loss u along the 12 EMA by using a trailing stop-loss order. Exit the trade when the stock price candlestick closes below the 12EMA.

What Type Of Trading Strategies Can Falling Wedge Patterns Be Traded In?

Falling wedge patterns can be traded in trading strategies like day trading strategies, swing trading strategies, scalping strategies, and position trading strategies.

What Are the Falling Wedge Pattern Trading Rules?

The falling wedge pattern trading rules are below.

- Risk 1% of trading capital total

- Enter a buy trade on a price breakout only

- Set the stop-loss level at the pattern's downward sloped support level only

- Avoid trading the pattern in illiquid markets with little volume

- Understand the entry price, exit price, and stop loss price prior to trade entry

- Avoid trading the pattern prior to or during important market news events

- Avoid trading the pattern in extremely volatile markets

What Are Common Mistakes When Trading Falling Wedges?

The falling wedge pattern trading mistakes are not waiting for the price breakout level before entering a trade, trading the pattern in illiquid markets, not understanding the correct risk level, and trading the pattern prior to important market news announcements.

What Are The Risks Of Trading Falling Wedges?

The falling wedge pattern trading risks are a risk of a price gap down causing a trading loss, risk of unexpected news causing increased market volatility, and the risk of low trading liquidity causing trade slippage.

What Type of Traders Trade Falling Wedges?

A falling wedge pattern is traded by scalpers, day traders, swing traders, position traders, long-term traders, technical analysts, and active investors.

What Are Falling Wedge Pattern Examples?

The falling wedge chart patterns historical examples are below.

Falling Wedge Continuation Pattern Example

A falling wedge continuation pattern example is illustrated on the daily stock chart of Wayfair (W) stock above. The stock price trends in a bullish direction before a price pullback and consolidation range causes the falling wedge formation. Wayfair price coils and breaks above the pattern resistance area and rises in a bull trend to reach the profit target area.

Falling Wedge Reversal Pattern Example

A falling wedge reversal pattern example is displayed on the daily forex chart of USD/JPY above. The currency price initially drops in a bear trend before forming a falling wedge reversal. The currency price reverses from bearish to bullish and starts to move higher in a bull direction.

Falling Wedge Pattern Short Timeframe Example

A falling wedge pattern short timeframe example is shown on the hourly price chart of Soybean futures above. The futures price drops in a downward direction before a short term falling wedge pattern forms. The Soybeans price breaks out of the pattern to the upside in a bull direction and continues higher to reach the exit price.

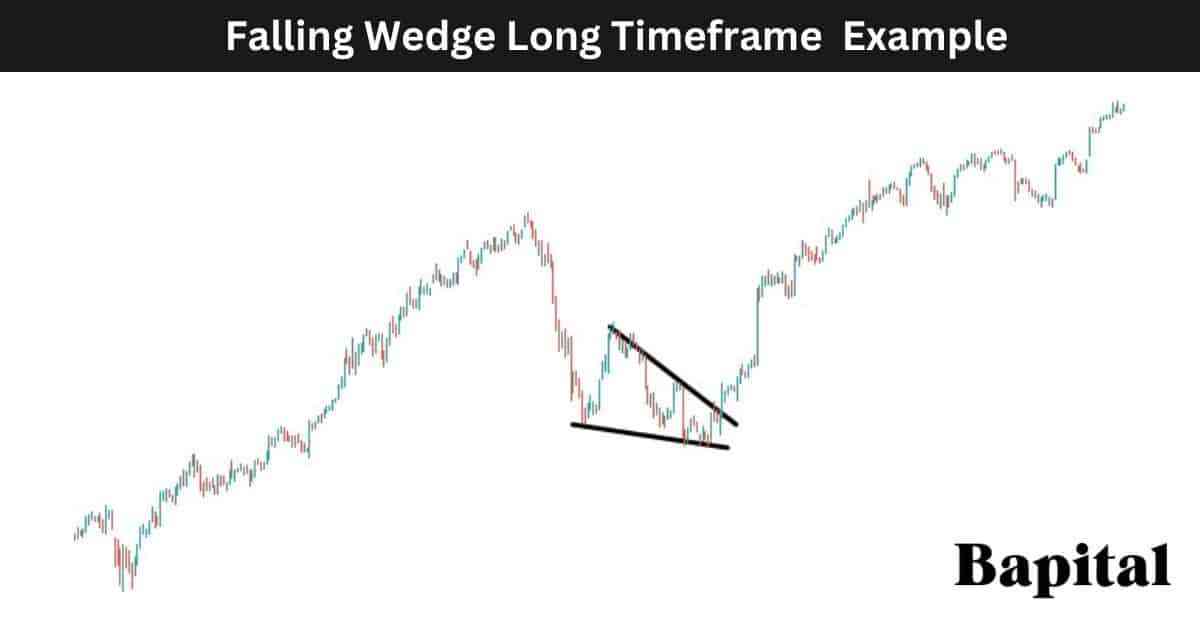

Falling Wedge Pattern Long Timeframe Example

A falling wedge pattern long timeframe example is displayed on the weekly price chart of Netflix above. The stock price initially trends upwards before a price retracement and consolidation period where the pattern developes. The Netflix price breakout occurs and the Netflix stock continues rising for multiple months where it reaches the profit target level.

What Are The Benefits Of a Falling Wedge Pattern?

The falling wedge pattern benefits are listed below.

- Helps Capture Large Bullish Price Moves: A falling wedge pattern can help traders capture large bullish price trends when the market security price breaks out from the pattern to the upside

- Helps Offer High Reward to Risk Ratio: A falling wedge can offer a high reward to risk ratio typically risking $1 to make $3.5+ per trade

- Helps Understand Price Action: A falling wedge can help traders understand the price action and what is happening in a market where the pattern is forming

- Works In Multiple Markets And Multiple Timeframes: Falling wedge patterns works in all financial markets and they work on all price chart timeframes without restrictions

What Are The Limitations Of a Falling Wedge Pattern?

The falling wedge pattern limitations are listed below.

- False Signals: A falling wedge can create many false breakout signals before the real price breakout occurs. This can frustrate traders trying to catch the real bullish breakout when it occurs

- Subjectivity: Identifying falling wedge patterns involves a degree of subjectivity with different traders intrepreting the chart pattern differently which can lead to errors and mistakes

- Not Foolproof: Falling wedges do not guarantee a bullish price trend. Market condition can change and economic or political news events can cause the pattern to fail

What Technical Indicators Are Used With Falling Wedge Patterns?

Falling wedge patterns are used with technical indicators like moving average overlays, average true range, volume indicator, volume profile, bollinger bands, keltner channels, R.S.I., moving average convergence divergence (MACD), and the parabolic sar.

What Is The Most Popular Technical Indicator Used With Falling Wedge Patterns?

A falling wedge pattern most popular indicator used is the volume indicator as it helps traders understand the strength of a pattern price breakout.

What Is The Least Popular Technical Indicator Used With Falling Wedge Patterns?

A falling wedge pattern least popular indicator used is the parabolic sar as it creates conflicting trade signals with the pattern.

What Technical Indicator Is Used As A Confirmation Signal With a Falling Wedge?

A falling wedge pattern confirmation technical indicator is the volume indicator as the volume indicator confirms the presence of large buyers after a pattern breakout.

What Is a Falling Wedge Pattern Failure?

A falling wedge pattern failure, also known as a "failed falling wedge", is when the falling wedge pattern forms but market prices fail to continue higher. The falling wedge pattern is invalidated and fails when the market price breaks out above the buy trade entry point in a bullish movement but the price reverses from above the pattern resistance breakout level to trend downwards below the pattern's declining support level. A failed falling wedge pattern is a bearish signal in capital markets.

What Causes a Falling Wedge Pattern To Fail?

Falling wedge pattern failure causes are listed below.

- Low Liquidity: Low liquidity with very little trading volume can cause a falling wedge pattern to fail as there is no volume to push prices higher

- Unexpected Market News: A falling wedge can fail if unexpected market news causes the asset price to drop downward

- Major Overhead Resistance: A falling wedge pattern fails if there is major overhead resistance above the pattern's breakout level as the asset price will struggle to break this level

What Is The Psychology Behind a Falling Wedge Pattern?

The falling wedge pattern psychology involves an initial bearish sentiment during the market price consolidation with a slow price decline lower phase. As security prices bounce off the declining support line, buyers start to show some optimism that a price bounce will occur. As price narrows further between a price pullback and price bounce, traders are confused and lack confidence on the correct price trend direction. After a price breakout occurs, traders become extremely optimistic and hopeful of further price increases.

When Are Traders Optimistic During the Falling Wedge Pattern Formation?

Traders are optimistic during the falling wedge pattern formation when the market price rises above the pattern resistance level on rising buyer volume as this signals potential further upward bullish momentum.

When Are Traders Pessimistic During the Falling Wedge Pattern Formation?

Traders are pessimistic during the falling wedge pattern formation when the market price is declining and rangebound between the pattern's support and resistance area.

What Are The Statistics Of a Falling Wedge Pattern?

Falling wedge pattern statistics are illustrated on the statistics table below. All falling wedge pattern statistical data has been calculated by backtesting historical data of financial markets.

How Accurate Is a Falling Wedge Pattern?

A falling wedge pattern accuracy rate is 48% over 9,147 historical examples over the last 10 years.

What Timeframe Has The Highest Falling Wedge Pattern Win Rate?

The falling wedge pattern's highest win rate is 59% on the daily price charts over 476 historical price chart examples.

What Timeframe Has The Lowest Falling Wedge Pattern Win Rate?

The falling wedge pattern's lowest win rate is 34% on the 1-second timeframe chart over 631 examples.

Is a Falling Wedge Pattern Reliable?

Yes, a falling wedge pattern is reliable with a 48% average win rate making it one of the most reliable chart patterns.

Is a Falling Wedge Pattern Profitable?

Yes, falling wedge patterns are profitable with a win rate of 48% and a high return ratio of 3.5:1 making them profitable. However, past performance is not indicative of future results.

How Can Traders Make a Falling Wedge Pattern More Profitable?

Traders can make a falling wedge pattern more profitable by avoiding trading the pattern on shorter timeframes due to increased false signals and by increasing position sizes on winning trade positions.

What's The Difference Between a Falling Wedge and an Ascending Triangle?

The falling wedge pattern difference with an ascending triangle is its shape with a falling wedge shaped with two downward sloping resistance and support trendlines while an ascending triangle has a hoprizontal resistance line and an upward sloped support line.

What Are Falling Wedge Pattern Alternatives?

Falling wedge pattern alternatives are listed below.

- Cup & handle

- Bullish rectangle pattern

- Double bottom chart pattern

- Triple bottom chart pattern

- Diamond bottom chart pattern

- Rounded bottom pattern

- Bull flag pattern

- Pennant pattern

What Is The Most Popular Falling Wedge Pattern Alternative?

A falling wedge pattern most popular alternative is the bull flag pattern.

What Is The Opposite Of a Falling Wedge Pattern?

The falling wedge pattern opposite is the rising wedge pattern which is a bearish signal.

What Are Falling Wedge Pattern Resources To Learn From?

Falling wedge pattern resources to learn from include books, audiobooks, pdfs, websites, and courses.

What Are Books To Learn About Falling Wedge Patterns?

Falling wedge pattern books to learn from are "Technical Analysis of Financial Markets" by technical analyst John Murphy and "Getting Started In Chart Patterns" by Thomas Bulkowski.

What Are Websites To Learn About Falling Wedge Patterns?

Websites to learn about falling wedge patterns are Bapital.com and Investopedia.com.

What Are Courses To Learn About Falling Wedge Patterns?

Courses to learn about falling wedge patterns are "Technical Analysis: Chart Pattern Trading For Beginners" by Wealthy Education and "Introduction To Technical Analysis" by the Chart Guys.

What Are the Falling Wedge Pattern Key Facts?

The falling wedge pattern key facts are below.